While taxes are normally due April 15th, this year Congress extended the filing deadline to July 15th.

Today, July 15th, is the deadline to file your 2019 Form 1040 tax return, unless you’ve filed an extension to October 15th.

Here some tips for tax day and a little tax day history.

The April 15th deadline

The first tax return was due March 1, 1914. Tax day was then changed to March 15 in 1918.

In 1955 tax day was again changed to April 15 and has remained so ever since.

The first tax return

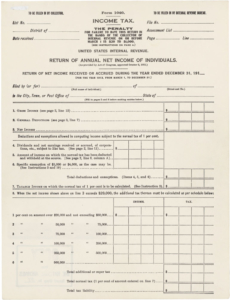

A copy of the 1913 tax return that was due on March 1, 1914:

The first tax return had very generous tax rates at between 1% and 6%. But don’t try submitting this one to the IRS!

Under the 1913 revenue act, anyone with an annual income exceeding $3,000 (single) or $4,000 (married) was required to file a tax return.

File on time, even if you can’t pay

If you file your federal tax return late and owe tax with the return, two penalties may apply.

The first is a failure-to-file penalty for late filing. The failure-to-file penalty is normally 5 percent of the unpaid taxes for each month or part of a month that a tax return is late. It will not exceed 25 percent of your unpaid taxes.

The second is a failure-to-pay penalty for paying late. The failure-to-pay penalty is generally 0.5 percent per month of your unpaid taxes. It will not exceed 25 percent of your unpaid taxes.

So, the lesson here is that even if you can’t pay your taxes on time, you should at least file on time! And then request a payment plan with the IRS if necessary. The penalty for late filing is much greater than the penalty for late payment.

Oh no! My dog ate my W-2.

Don’t worry. If you haven’t filed yet, you can still request an extension to October 15 by filing Form 4868. But you have to file it by today (July 15th).

Note that filing an extension does not extend the time to pay. To avoid failure to pay penalties, you must make an tax payment with your extension.

Postmarked Date Rule

With electronic filing now the norm, the postmarked date isn’t as relevant anymore. But there are some individual returns that must be paper filed, and some folks still prefer filing the old fashioned way.

Under IRC 7502, any return or payment received after its due date is treated as filed or paid on the postmark date.

Always send any documents to the IRS via certified mail return receipt, or through a carrier that offers tracking so you can establish the postmark date.