Follow these steps to claim the Recovery Rebate Credit on your 2020 Form 1040.

Step 1:

Get a copy of your Notice 1444 and 1444-b. These notices will indicate the amounts of stimulus payments (Economic Impact Payments) that you received.

If you do not have these notices, you’ll need to know how much you received. If you don’t remember, you can check your bank statements or log into Get my Payment at IRS.gov.

Step 2:

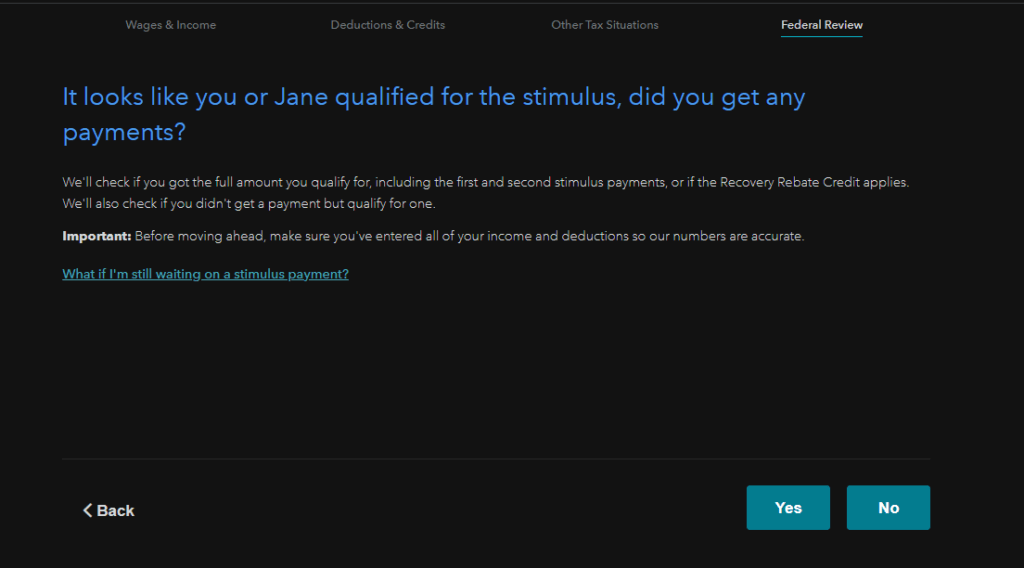

After you’ve entered in all your tax information, go to the tab “Federal Review.”

TurboTax will check to see if you qualify for the stimulus based on your responses on the previous screens.

If you qualify, you’ll see the following screen in TurboTax.

If you did receive stimulus, select yes. Otherwise, select no.

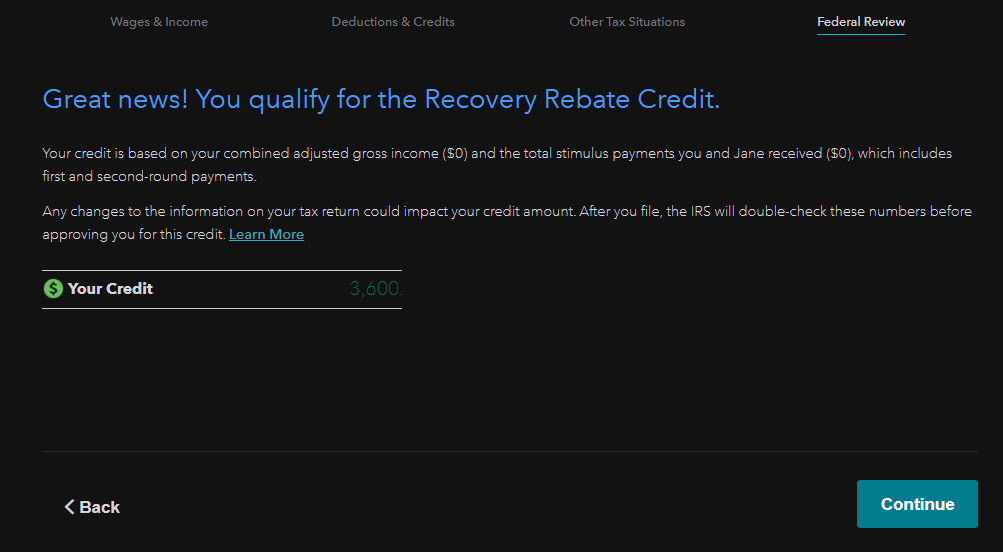

If you did not previously receive a stimulus or did not receive the full amount of stimulus, you’ll see the following message.

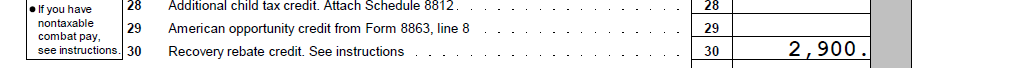

When you print a copy of your tax return, you should see your recovery rebate credit on line # 30, found on the 2nd page of Form 1040.

Be sure to consult with a tax professional before filing your tax return.

I did not receive $ 1400 stimulus check in 2021. How do i write on 1040 tax form on turbo tax?

When you have it ready, enter all of your federal return information as you would normally.

During the Federal Review, it’ll check if you meet eligibility requirements for the stimulus payment.

If you meet the requirements, you’ll see the Did you get a third stimulus? screen.

Answer a few questions about any payments you’ve already received and then it’ll let you know if the Recovery Rebate Credit applies.

If you need to make any changes to your stimulus credit responses, search for stimulus and select the jump-to link to return to the section. Enter your updated info and Continue.