In a recent tax forum, the IRS stated that they are drafting a new Letter 6152 that will be sent to taxpayers who haven’t settled their tax debt. The letter will warn such taxpayers that their passport will be revoked.

The authority to revoke passports for “seriously delinquent tax debt” is provided under Internal Revenue Code § 7345.

What is seriously delinquent tax debt?

Under Section 7345(b)(1), seriously delinquent tax debt means an unpaid federal tax liability:

(1) That is is greater than $52,000 (inflation-adjusted); and

(2) For which a notice of lien has been filed or levy has been made.

Will I get a warning before this happens?

Before the IRS will issue the Letter 6152 to revoke your passport, they must first certify the seriously delinquent tax debt to the State Department.

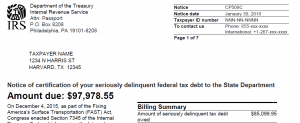

The taxpayer will receive a Notice CP 508C once it certifies the debt. The IRS will send written notice by regular mail to the taxpayer’s last known address.

Your Power of attorney (POA) will not receive a copy of your CP 508C.

Here’s what a CP 508C notice looks like:

What do I do if I get a CP 508C Notice?

You or your representative should contact the IRS to resolve the tax debt by making arrangements to pay. The IRS will reverse a certification when:

- The tax debt is fully satisfied or becomes legally unenforceable.

- The certification is erroneous.

- You and the IRS enter into an installment agreement allowing you to pay the debt over time.

- The IRS accepts an offer in compromise to satisfy the debt.

- The Justice Department enters into a settlement agreement to satisfy the debt.

- Collection is suspended because you request innocent spouse relief under IRC § 6015.

- You make a timely request for a collection due process hearing regarding a levy to collect the debt.

Note that while a installment agreement or offer in compromise must be accepted before the IRS will reverse a certification, an innocence spouse claim or timely request for collection due process (CDP) hearing does not require acceptance; the filing of the claim or CDP will reverse the certification.

You should always consult with a tax professional before making any decisions about how to best resolve your particular matter.

Options for resolving tax debt

Taxpayers that owe outstanding IRS tax debt should apply for one of the collections alternatives: